Cynapsus Therapeutics Inc. (CYNA) long-awaited U.S. initial public offering is set to close early next week. The company recently announced that it plans to offer 4.5 million shares of common stock at a price of $14.00 per share. Gross proceeds from the offering total $63.0 million. The company has granted to the underwriters (sole book-runner BoA Merrill Lynch) an option to purchase up to an additional 0.675 million shares, which if exercised would bring the total gross proceeds from the offering to $72.45 million. After fees and assuming underwriters exercise the over-allotment, we expect Cynapsus to walk away with approximately $67 million.

Cynapsus exited March 2015 with approximately $30 million in cash on the books. We remind investors that during the first quarter 2015, the company raised approximately $19.6 million in cash, with $3.5 million coming from shareholders exercising outstanding warrants and $16.1 million through a private placement of 1.375 million shares at $12.40 per share. The financing in late March 2015 was led by funds associated with OrbiMed, Aisling Capital and Venrock, with participation from various other institutional investors, including existing shareholders Broadfin Capital, Sphera Funds Management, Pura Vida Investments, DAFNA Capital Management and Dexcel Pharma Technologies Ltd / Dexxon Holdings Ltd.

Assuming the over-allotment is exercised, we believe Cynapsus will hold over $90 million in cash in July 2015. Management plans to use the cash as follows:

– $25 million to fund pre-approval commercialization efforts in the U.S.

– $12 million to initiate clinical and regulatory activities in the EU

– $5 million to complete CMC related expenses

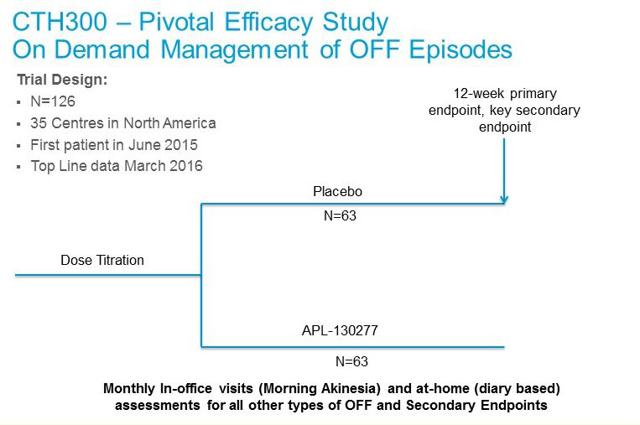

– $3 million to fund early-stage pipeline developmentOnce the public offering has completed, the basic share count will stand at roughly 12.1 million. The fully-diluted share count, which includes approximately 3.3 million warrants that if exercised will gross CDN$37.9 and 0.6 million stock options that if exercised will gross CDN$9.5 million, will stand at approximately 16.0 million. The basic market capitalization of the NASDAQ-listed shares is approximately $169 million ($224 million fully-diluted). The enterprise value of the company upon closing of the full offering will be approximately $78 million. Our financial modeling shows the shares are worth approximately $395 million on an enterprise value today. On a total value, probability-adjusted basis, we believe the NASDAQ-listed shares are worth $30.Phase 3 Trial Underway!In February 2015, Cynapsus held a face-to-face meeting with the U.S. FDA to discuss the “end of Phase 2” and map-out the path forward toward the New Drug Application (NDA). In March 2015, the company provided to investors a road-map toward the U.S. NDA filing, which will be through the expedited 505(b)(2) pathway. To be in position to file for approval, the company must conduct two pivotal Phase 3 registration trials, an efficacy trial dubbed CTH-300 and an open-label safety trial dubbed CTH-301. The company must also conduct a bioavailability / bridging study comparing its drug to the Reference Listed Drug in Apokyn® (subcutaneous apomorphine injection), dubbed CTH-200.

– CTH-301: Cynapsus will also enroll a pivotal six month safety study that will consist of the 126 patients from the CTH-300 trial plus another 100 de novo patients. The primary endpoint of this study is safety, with analysis looking at adverse events, oral tolerability, and impact on cardiac function assessed by electrocardiogram. Enrollment in this trial should start in the third quarter 2015, roughly 12 weeks after the first patient complete the placebo-controlled portion of CTH-300 study. Top-line data from CTH-301 is expected in October 2016.

– CTH-301: Cynapsus will also enroll a pivotal six month safety study that will consist of the 126 patients from the CTH-300 trial plus another 100 de novo patients. The primary endpoint of this study is safety, with analysis looking at adverse events, oral tolerability, and impact on cardiac function assessed by electrocardiogram. Enrollment in this trial should start in the third quarter 2015, roughly 12 weeks after the first patient complete the placebo-controlled portion of CTH-300 study. Top-line data from CTH-301 is expected in October 2016. – CTH-200: The final step before the NDA filing is a short bridging study, planned to be a single-dose, crossover comparative bioavailability and pharmacokinetic (PK) study in healthy volunteers. This study is designed to allow Cynapsus to use the safety and efficacy data for the Reference Listed Drug (Apokyn®) in its 505(b)(2) NDA submission to the FDA. We expect this to begin in the third quarter 2015.In parallel to these studies, Cynapsus will be performing the necessary scale-up, process validation and stability as part of the Chemistry, Manufacturing and Controls (CMC) requirements for the filing of the NDA. In mid-March 2015, the company announced that it had entered into an agreement with ARx, LLC whereby ARx agreed to provide Cynapsus with formulation, CMC and clinical unit production of APL-130277 and certain related services to support the planned clinical studies noted above. Under the terms of the agreement, ARx also assigned all of its right to the sublingual film patent family to Cynapsus. In return, Cynapsus granted ARx a non-exclusive license to this patent family in all fields other than generic APL-130277 applications. We remind investors that management has earmarked $5 million in funds to complete all the necessary CMC work prior to the NDA filing. Cynapsus has also earmarked $3 million for early-stage pipeline development, which we suspect includes exploring the use of additional drug candidates on the sublingual film technology.If all the above goes smoothly, we believe Cynapsus will be in position to file the U.S. NDA application before the end of 2016. With standard review, APL-130277 should receive a PDUFA date in the U.S. during the second half of 2017. We believe a take-out of the company is likely after the U.S. NDA filing.Acorda Acquires Civitas And Validates The Market

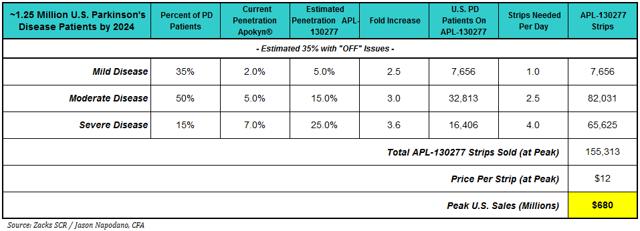

– CTH-200: The final step before the NDA filing is a short bridging study, planned to be a single-dose, crossover comparative bioavailability and pharmacokinetic (PK) study in healthy volunteers. This study is designed to allow Cynapsus to use the safety and efficacy data for the Reference Listed Drug (Apokyn®) in its 505(b)(2) NDA submission to the FDA. We expect this to begin in the third quarter 2015.In parallel to these studies, Cynapsus will be performing the necessary scale-up, process validation and stability as part of the Chemistry, Manufacturing and Controls (CMC) requirements for the filing of the NDA. In mid-March 2015, the company announced that it had entered into an agreement with ARx, LLC whereby ARx agreed to provide Cynapsus with formulation, CMC and clinical unit production of APL-130277 and certain related services to support the planned clinical studies noted above. Under the terms of the agreement, ARx also assigned all of its right to the sublingual film patent family to Cynapsus. In return, Cynapsus granted ARx a non-exclusive license to this patent family in all fields other than generic APL-130277 applications. We remind investors that management has earmarked $5 million in funds to complete all the necessary CMC work prior to the NDA filing. Cynapsus has also earmarked $3 million for early-stage pipeline development, which we suspect includes exploring the use of additional drug candidates on the sublingual film technology.If all the above goes smoothly, we believe Cynapsus will be in position to file the U.S. NDA application before the end of 2016. With standard review, APL-130277 should receive a PDUFA date in the U.S. during the second half of 2017. We believe a take-out of the company is likely after the U.S. NDA filing.Acorda Acquires Civitas And Validates The MarketWe have been saying that the market opportunity for an effective rescue medication to treat off episodes in Parkinson’s patients in a potential multi-hundred million-dollar opportunity. We estimated the peak U.S. sales for APL-130277 are around $700 million. We note that this does not include forecasts for sales in Europe or Asia, and as part of the planned activity over the next 12-18 months Cynapsus does intend to engage with European regulators to discuss the clinical and regulatory strategy for APL-130277 in the EU. As noted above, the company has earmarked $12 million in funds for this endeavor.

The prevalence of off episodes is significant in our view. According to various peer-reviewed literature (Muenter AJE, 2001; Rascol et al, 2000, Lopez I et al, 2010), after five years of treatment with levodopa, approximately 30-60% of all Parkinson’s patients will experience wearing off episodes. After ten years of treatment with levodopa, virtually all PD patients (~95%) suffer from off episodes. We estimate there will be approximately 1.25 million PD patients in the U.S. by 2024 (year of peak sales). Our U.S. sales model for APL-130277 is show below.

On September 24, 2014, Acorda Therapeutics announced it had made an offer to acquire privately-held Civitas Therapeutics for $525 million in cash. The impetus of the acquisition by Acorda was to get CVT-301, a Phase 3 inhaled formulation of levodopa for the treatment of off episodes in Parkinson’s patients. With CVT-301, Acorda believes it has an attractive late-stage asset to add to the company’s CNS-focused pipeline. The CVT-301 Phase 3 study began enrollment in December 2014. The estimated completion of the study with data is June 2016, putting Cynapsus drug about two months ahead. Nevertheless, the new drug application (NDA) for CVT-301 is also planned for late 2016, similar to APL-130277. Acorda estimates the market opportunity for CVT-301 is in excess of $500 million, consistent with what we believe and model. Civitas had been previously planning an initial public offering, but the $525 million all-cash offer from Acorda was simply too attractive to pass up.

Specifically, CVT-301 is an inhaled formulation of levodopa. Levodopa is the most common form of dopamine replacement therapy, a backbone regimen and standard of care for the treatment of Parkinson’s disease. Parkinson’s disease is a slowly progressing neurological disorder characterized by tremor, stiffness and decreased movement. The decreased movement is a direct result of the lack of dopamine in the brain. Levodopa, when taken orally, is converted into dopamine in the substantia nigra by dopa decarboxylase.

The administration of levodopa temporarily diminishes the motor symptoms associated with the lack dopamine in the substantia nigra. Carbidopa, a dopa decarboxylase inhibitor, is commonly dosed with levodopa to prevent L-DOPA metabolism before it reaches the blood-brain barrier. In fact, co-formulations of levodopa/carbidopa (Sinemet-CR) are available. Civitas’ formulation of levodopa bypasses the gut metabolism through inhalation, a pathway known to for rapid uptake and onset of action.

There are, however, major limitations to the use of levodopa as a treatment for Parkinson’s disease. Mainly, the patient must have substantial remaining dopaminergic neurons in the substantia nigra to metabolize the drug. However, according to research published in the Journal of Neural Transmission by P. Riederer et al in 1976, pathological studies of Parkinson’s disease show at least 70-80% of the dopaminergic neurons are lost before the onset of symptoms. The effectively creates a “shelf-life” for levodopa treatment as the standard of care in patients with PD. This work was confirmed by K. Yoshikawa et al, 2004.

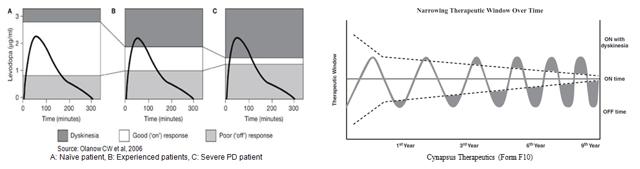

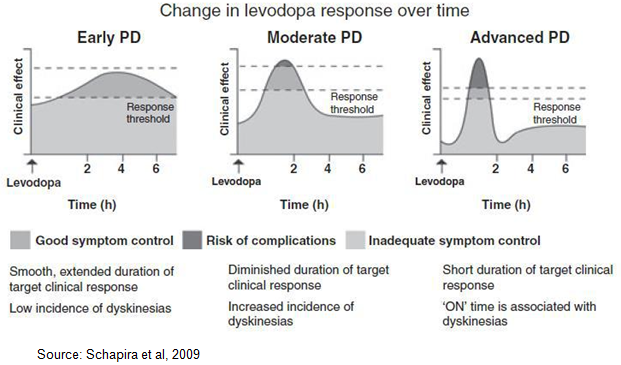

This explains why levodopa is very effective for a period of time, then wanes with disease progression. A newly diagnosed Parkinson’s patient has the capacity, albeit diminished, to process levodopa. As the patient loses this capacity, the therapeutic window for levodopa therapy begins to narrow. Levodopa also has a relatively short half-life of only 60-90 minutes. The drugs effect, even in the mild Parkinson’s patient, only lasts for 1.5 to 2.0 hours post dose (Brooks, D, 2008). Work done by Olanow et al, 2006 shows the therapeutic window for a Parkinson’s disease patient rapidly closes (narrows) as patients gain experience with Levodopa use. This is due to a combination of disease progression, loss of dopaminergic neurons in the substantial nigra, and the short half-life of the drug (left). A similar graphical representation of this effect can be found in Cynapsus public filings (right).

As such, dosing dynamics for levodopa are challenging (Schapira et al, 2009). Too much drug (or too frequent dosing) leads to leads to dyskinesia, a direct result of excess dopamine in the brain. Too little drug leads to increase “off” time (bradykinesia / akinesia), the specific condition that both Civitas and Cynapsus are aiming to treat.

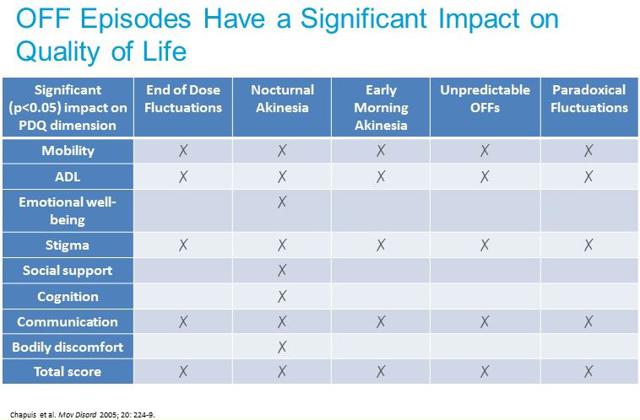

Levodopa also has an unreliable clinical response, marked by dose-by-dose variability in plasma concentrations and the challenging pharmacokinetic profile of the drug (LeWitt PA, 2015). As such, off episodes can be unpredictable and in some cases episodes may be preceded by non-motor symptoms such as pain, tingling, sweating, and anxiety, which can alert patients that motor-impairing symptoms are returning. Off episodes are generally categorized into the following four main types, as shown in the below diagram, which illustrates one patient’s response to levodopa over the course of a day.

According to work done by Chapuis et al, 2005, wearing off is the most common type of motor fluctuation associated with the long-term use of levodopa, occurring in approximately 80% of levodopa experienced PD patients. Peak-dose dyskinesia is the second most common occurrence, found in roughly 75% of all PD patients. Morning off (also called morning akinesia) and dose failure (paradoxical failure) are also common after long-term levodopa use, occurring in approximately 60% of PD patients. Unpredictable off, while the least common motor fluctuation, still occurs in approximately 35% of all of levodopa experienced PD patients. Clinical data from Cynapsus Phase 2 program shows that APL-130277 works in all four types of off episodes. We believe that patients taking CVT-3011, an inhaled levodopa, will be susceptible to the unpredictable off or dose failure episodes, as well as also be at elevated risk for levodopa-induced dyskinesia.

As such, we question the concept of treating off episodes in Parkinson’s patients with more levodopa. Many neurologists and movement disorder doctors will delay the use of levodopa in newly diagnosed Parkinson’s patients specifically to avoid the narrowing of the therapeutic window and the risks of complications such as dyskinesia (see this YouTube video from the MJFF talking about Levodopa and off/on time). We believe CVT-301 complicates the dosing regimen for the Parkinson’s patient taking a drug like Sinemet-CR. We suspect substantial acceleration of the narrowing of the therapeutic window and dyskinesia with the drug’s use. And as the Parkinson’s patient progresses from mild to moderate or severe disease, we suspect that CVT-301 will become a less effective drug. We also strongly question the approvability of an inhaled drug, with chronic use, in an elderly population for a non-pulmonary disease. As such, we think the pathway to approval for CVT-301 seems arduous.

Apomorphine, the active drug in the only currently approved rescue medication for the treatment of off episodes in the U.S. in Apokyn®, is not a dopamine replacement therapy. Apomorphine is a dopamine agonist, and acts directly at the post-synaptic dopamine receptor, thus bypassing the need for dopamine and dopaminergic neurons in the substantial nigra. Instead, apomorphine can act directly on the gabaergic neurons that are not impacted by Parkinson’s disease, and provide an effective treatment option as a rescue medication to patients at all stages of disease progression.

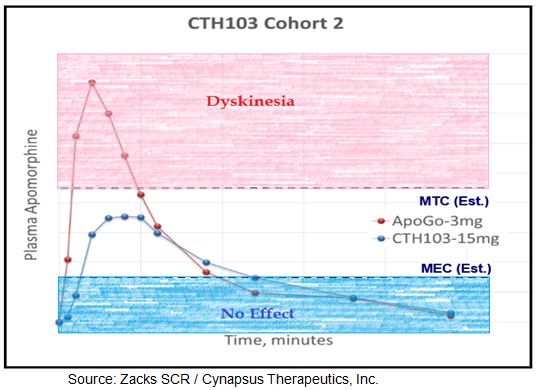

The knock on apomorphine is that because the drug is rapidly metabolized by the liver, it must be administered by a route that bypasses the gut. As such, the currently approved formulation of apomorphine in the U.S. is a subcutaneous injection. Subcutaneous injectable apomorphine, sold in the U.S. as Apokyn®, is a horrible impractical and inefficient drug, flawed by its delivery system and quick peak-to-trough pharmacokinetic profile. Apomorphine is highly lipid soluble and quickly crosses the blood-brain barrier. Onset of action is as little as five minutes, but only lasts for 60-90 minutes. Under QID dosing for levodopa, patients with advanced disease may still experience off episodes.

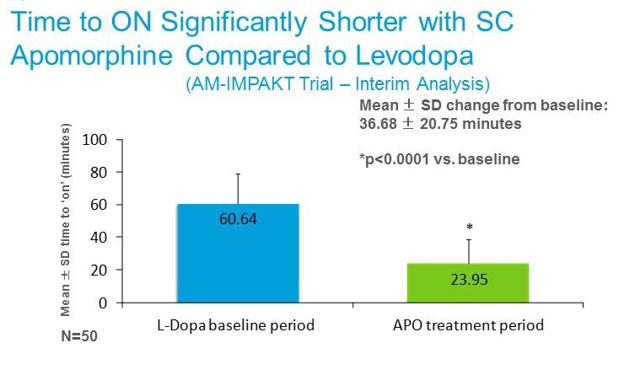

Apomorphine is also far more rapidly active than levodopa. The slide below from Cynapsus investor presentation shows data from the AM-IMPAKT Trial comparing the mean change in baseline “time to on” with oral levodopa vs. subcutaneous apomorphine. Therefore, for all the reasons discussed above, we believe apomorphine is an effective rescue medication for patients experiencing off episodes.

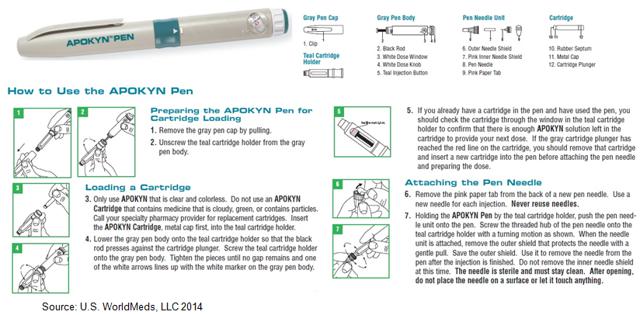

Unfortunately, self-administration of subcutaneous Apokyn is next to impossible for the akinetic (or dyskinetic) Parkinson’s patient. For example, the Instructions For Use for Apokyn® is 27 pages long, and consists of steps that logically seem impossible for the frozen or rigid Parkinson’s patient to complete. Because self-administration of Apokyn® is nearly impossible, the treatment of “off” episodes requires direct caregiver support, likely from a skilled nurse. There is also titration issued to contend with, as well as injection site-reactions. This places undue burden on the healthcare system.

The above inhibiting attributes greatly limit sales of Apokyn in the U.S. Cynapsus’ APL-130277 is a sublingual formulation of apomorphine, with each thin film strip found inside an easy to open non-superimposable die cut peelable foil laminate pouch. The product can be self-administered, under the tongue, and is designed to be used anywhere, anytime, with little or no assistance required. Compare the 27 page instructions for use with Apokyn® vs. a cartoon we adapted from Cynapsus prospectus Form F10 below.

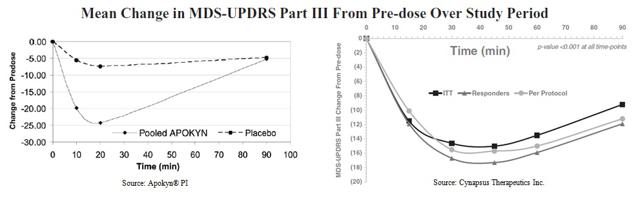

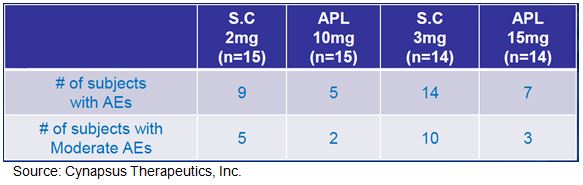

However, beyond the convenience aspect of APL-130277, we believe the drug offers adequate efficacy without significant risk of dyskinesia or injection-site reactions. Below is a graphical representation of the Apokyn® efficacy on the UPDRS scale taken from the drugs prescribing information (left). Compared to pre-dose baseline score, the mean change in score was around -25 at approximately 18 minutes post-dose. The effect of the drug matches that of placebo after 90 minutes. On the right we show the Phase 2 data from Cynapsus’ CTH-105 study. The mean change in UPDRS compared to pre-dose baseline on the per protocol basis is -16, with peak effect taking place after 30 minutes.

There are some important aspects of the Cynapsus data that investors need to understand:

– Thirdly, the effective onset is slower. However, there are two important points investors must understand about onset and duration: 1) clinically meaningful improvement in motor function was seen in as early as 10 minutes for the majority of patients on APL-130277 and 2) the effect last far longer, with still clinically meaningful effect observed at 90 minutes (end of analysis). So while APL-130277 may not be as rapid acting as Apokyn®, the effect is still fast enough to turn the majority of patients back to on in 10 minutes and the effect is likely long-enough to provide an effective bridge between levodopa dosing (assuming levodopa dosing every 4 hours).

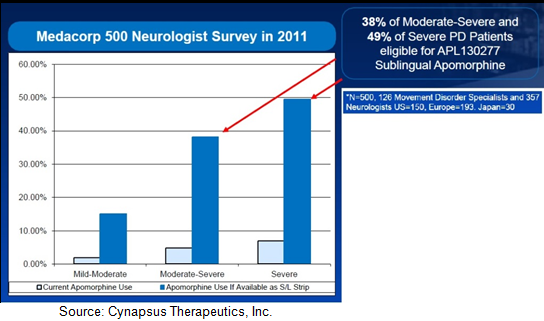

The comparable dose strength of Apokyn® sells for $13-15 per injection. We believe Cynapsus APL-130277, with a far more convenient administration and lack of skilled caregiver requirement, will see sizable market shares gains and expansion over the current Apokyn market. For example, Cynapsus sponsored neurologist surgery (n=500) with data conclusions suggesting a 7.5-fold increase in penetration across the board for mild, moderate, and severe Parkinson’s patients. It is for these reasons that we believe APL-130277 has peak U.S. sales far in excess of Apokyn®, or Acorda’s newly acquired CVT-301.

Signs Point To Fundamental StrengthSince we first initiated coverage on Cynapsus in June 2013, management has come a long way in preparing the company for the pending Phase 3 program. Below are several “pieces” put into place or little signs of credibility / validation to the Cynapsus story:

Signs Point To Fundamental StrengthSince we first initiated coverage on Cynapsus in June 2013, management has come a long way in preparing the company for the pending Phase 3 program. Below are several “pieces” put into place or little signs of credibility / validation to the Cynapsus story:– Raised significant new cash with quality institutional investors in April 2015.

– Announced the appointment of a Chief Scientific Officer (CSO), Thierry Bilbault, PhD, in October 2014.

– Announced the appointment of a VP Medical Affairs, Jordan Dubow, M.D., in November 2014.

– Announced a new board member, Tamar Howson in March 2015.

– Raised $20 million in new capital in March 2015, with high-quality firms like OrbiMed, Aisling, Venrock, Broadfin, Sphera, Pura Vida, Dafna, and Dexcel Pharma all participating in the offering.

– Uplisted the shares to the Toronto Stock Exchange in November 2014.

– Uplisted the shares to the NASDAQ in June 2015.

– Completed U.S. initial public offering lead by Bank of American Merrill Lynch, with potential gross proceeds of $72.45 million assuming full over-allotment.Conclusion, Valuation & RecommendationOff time is a significant problem for patients with advanced Parkinson’s disease. In the U.S., there are an estimated one million PD patients (4-6 million globally). According to a recent survey by the Michael J. Fox Foundation, more than 90% of PD patients report having off episodes each day. Roughly two-thirds have off time greater than two hours, with 20% experiencing off time of greater than four hours. This is a significant problem for PD patients and has meaningful quality of life impact (see chart below).A recent paper published by researchers out of the UK on behalf of EUROPAR and EPDA confirms our belief that this is a potential enormous market. The paper concludes that early-morning “off” episodes are a significantly larger problem than believed even five years ago, with nearly two-thirds of all PD patients suffering across all stages of the disease. We view this as an enormous unmet medical need.

Data from the recently completed CTH-105 study clearly validates the proof-of-concept for APL-130277. The drug demonstrated clinical signs of efficacy for all doses. Onset of action was as soon as ten minutes for some patients, with mean “time to on” of 22 minutes – admittedly not as rapid as CVT-301 but still well within the reasonable range for a rescue medication. More importantly, duration of effect was still evident at 90 minutes, exceeding what has been demonstrated with Apokyn® or what we suspect will be shown in the CVT-301 Phase 3 trial given the half-life of levodopa has been documented to be less than 90 minutes.

Thanks to recent guidance from the U.S. FDA, the path to the U.S. NDA application has been confirmed and the key registration Phase 3 program is now enrolling patients. If all goes smoothly, we anticipate data from the CTH-300 program in March 2016, with the NDA to be filed before the end of that year.

We see APL-130277 as an easier-to-use and more effective drug than CVT-301, along with a better mechanism of action and pathway to approval. Data from CTH-105 de-risks the story and Cynapsus has enough cash to fund all the necessary clinical trials prior to the U.S. NDA filing. Management will also initiate pre-market commercialization activates and begin the clinical and regulatory work to bring APL-130277 forward in the EU. This is all designed to improve the attractiveness of the company to a potential pharmaceutical acquirer in 2016 or 2017.

We believe Cynapsus shares are currently worth $30.00. We arrive at this number by projecting peak U.S. sales for the drug in the $680 million range. We assume sales outside the U.S. will total another $400-500 million, all told bringing APL-130277 to approximately a $1.2 billion drug by 2025. We have built two separate valuation models around these sales assumptions, with heavy emphasis on the U.S. market only.

– The second is a 10-year discounted cash flow analysis projected U.S. and RoW sales to peak, 10% cost of goods sold, 5% residual operating expenses, 26.5% tax rate, and 20% discount rate. With a 75% probability of approval this values the company at approximately $505 million.

On a fully diluted basis, our $30.00 target equates to an enterprise value of approximately $485 million. We suspect that the company will still hold $30+ million in cash on hand at the end of 2016. We remind investors that Acorda paid $525 million for Civitas in 2014, Pfizer acquired Nextwave in 2012 for up to $700 million, and Lundbeck acquired Chelsea Therapeutics for $658 million in 2014. With the NDA under review by the end of the first quarter 2017, it would not surprise us one bit to see Cynapsus acquired for between $500 and $750 million. This range would equate to a 3+ fold increase in price for Cynapsus shareholders as of today.