Earlier in January, I alerted investors to the fact that 22nd Century Group (NYSEMTK: XXII) filed an MRTP application to the U.S. FDA for Brand-A, a code name for the company’s modified risk very low nicotine (VLN) cigarette that contains roughly 95% less nicotine per cigarette versus commercially available brands. MRTP stands for Modified Risk Tobacco Product, a nomenclature that only came about after the signing into law of the Family Smoking Prevention and Tobacco Control Act of 2009. Earlier this week, 22nd Century Group notified investors that almost immediately after the filing of the MRTP application, the U.S. FDA reached out to management and requested an onsite meeting at the FDA headquarters. That meeting took place last week, and management came away encouraged by the FDA’s attention to the filing and potential path forward to gain approval for Brand-A.

In my article below, I explain what MRTP is, how it came about, and why 22nd Century Group is sitting on a potential very big opportunity if the U.S. FDA approved Brand-A later in 2016.

MRTP and How It Came About

Almost all tobacco marketing practices ceased following the tobacco Master Settlement Agreement (MSA) of 1998. The agreement was entered into at the time by the country’s four major players, Philip Morris, R.J. Reynolds, Brown & Williamson, and Lorillard, and the attorneys general of 46 states. The MSA settled Medicare lawsuits targeting these major firms by the states, banned almost all commercial advertising of tobacco products, seeded anti-smoking advocacy groups, and funded education and awareness for smoking-related diseases. Thanks to the MSA, gone are the days of Joe Camel, the Marlboro Man, and celebrity endorsement of cigarettes.

In June 2009, the U.S. Congress passed Tobacco Control Act, which gave the U.S. FDA broad authority to regulate the manufacture, distribution, and marketing of tobacco products in the U.S. That is when additional restrictions on advertising and promotion came into play for the industry, and the U.S. FDA took over review of “modified risk” language on product labels to prevent potentially misleading claims by manufacturers of tobacco cigarettes.

Since the Tobacco Control Act of 2009, tobacco cigarette manufacturers can no longer use terms like “light,” “ultra-light,” “low tar,” or “all-natural” to describe their products. To gain approval for these types of claims, tobacco manufacturers must file applications with the U.S. FDA for review. Importantly, the application must contain clinical data supporting the modified risk claim.

In March 2012, the U.S. FDA issued Modified Risk Tobacco Product Applications Draft Guidance. The draft guidance provides details for those who seek to market a tobacco product as modified or lower risk including how to organize and submit an application, what scientific studies and analyses should be submitted, and what information should be collected through post-market surveillance and studies. To date, no company has been able to gain approval for a “modified risk” cigarette, although a few have tried and failed. Others have tried to skate around the labeling restrictions put forth by the TCA, only to be slapped back by the FDA.

22nd Century Group And Brand-A

22nd Century’s goal is to be the first company to gain approval for a modified risk cigarette code-named Brand-A in 2016. The company already manufactures MAGIC®, a commercially available and separate VLN cigarette, without the modified risk claim. Sales of MAGIC® are slowly ramping in Europe; however, it is safe to say that Brand-A, with a modified risk claim, will see significant acceleration in sales over the current trajectory with MAGIC® based on consumers desire to either quit smoking, smoke fewer cigarettes, or reduce the harm associated with smoking tobacco products.

Being able to claim that Brand-A is the first and only “reduced harm” cigarette on the market will surely lead to market share gains for 22nd Century Group or its partners. Vector Tobacco Inc. was able to grow its Quest 3 product, a VLN cigarette similar to MAGIC® to $60 million in wholesales sales, or about 26 million packs in 2007. End-user sales were likely in the area of $75 million. This is the commercial potential for MAGIC® in the U.S. I think Brand-A, which I view as MAGIC® with the MRTP language, as having ten-fold upside.

For example, according to market research done by JP Morgan, 90% of smokers would be willing to try a new brand if it were “safer” than their usual brand. This is evident by the fact that “light” cigarettes had 83.5% of the market prior to the TCA in 2009 that banned the use of that term (source: NCI, 2007). Roughly 45 million American’s smoke and retail sales of cigarettes in the U.S. were approximately $75 billion in 2014. A product that appeals to 90% of the market is potentially a very big product!

FDA Will Review 22nd Century’s MRTP Application

The takeaway from 22nd Century Group’s press release earlier this week is that the U.S. FDA is clearly interested in seeing a modified risk cigarette on the market. In the company’s press release, management at 22nd Century Group noted they were contacted by the agency, “Immediately upon receiving the application” and that a face-to-face meeting took place less than two weeks after the company’s submission. At that meeting, 42 members of the U.S. FDA staff, including 20 onsite and 22 who dialed in remotely, discussed the application with the company.

This is not the first time the agency or affiliates have expressed interest in the concept of a very low nicotine cigarette. As a reminder, nicotine is the addictive substance in cigarettes that smokers crave. Tar, among other chemicals, is the poison that causes cancer. The concept of a VLN cigarette is that if you reduce nicotine levels in cigarettes down to “non-addictive” levels, smokers would eventually lose interest in smoking. In June 2010, former U.S. FDA commissioner, Dr. David Kessler, MD, JD, stated, “The FDA should quickly move to reduce nicotine levels in cigarettes to non-addictive levels. If we reduce the level of the stimulus, we reduce craving. It is the ultimate harm reduction strategy.”

The idea has even peaked the interest of some of the country’s other leading public sector institutes, including the National Institute on Drug Abuse (NIDA), the U.S. National Cancer Institute (NCI), and the U.S. Centers for Disease Control and Prevention (CDC). In August 2010, affiliates from the above organizations, the FDA, RTI International, and 22nd Century Group got together to design “research cigarettes” with varying levels of nicotine, to be sold in the U.S. market so that the U.S. government can better understand smoking habits and addiction. 22nd Century Group was selected to participate in this study due to the company’s unique proprietary technology and ability to grow tobacco across a wide spectrum of nicotine levels.

Since the initial sub-contract, approximately 22 million SPECTRUM® brand cigarettes, in 24 styles with eight varying levels of nicotine, have been ordered to date, with the most recent 5.0 million purchase order from NIDA coming in September 2015. This is expected to generate approximately $0.6 million in revenues to 22nd Century Group. 22nd Century Group has since expanded its supply and distribution of SPECTRUM® brand cigarettes and is also looking to sign up additional research agreements with accredited organizations interested in purchasing tobacco cigarettes with varying levels of nicotine in the future. The monopoly that 22nd Century has on the proprietary technology to significantly alter the nicotine content in tobacco means that 22nd Century is the sole source of such unique products.

It All Comes Down To The Data

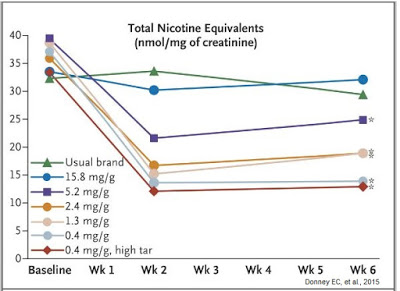

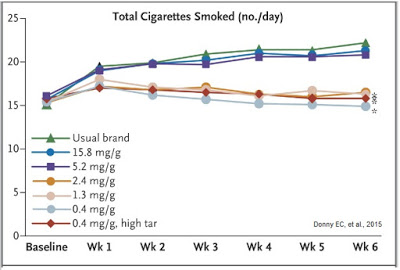

If the U.S. FDA is going to approve 22nd Century Group’s MRTP application, it will be on the back of strong clinical support. In October 2015, results from a randomized, double-blind, parallel-design trial using VLN SPECTRUM® brand cigarettes were published in The New England Journal of Medicine (NEJM). The 840 participant, six-week study (NCT01681875) took place between June 2013 and July 2014 at ten sites around the U.S. Eligibility criteria included adults smoking of five or more cigarettes per day with no current interest in quitting smoking. Participants were randomly assigned to smoke for six weeks either their usual brand of cigarettes or one of six types of investigational SPECTRUM® cigarettes provided for free. The investigational cigarettes had nicotine content ranging from 15.8 mg per gram of tobacco (typical of commercial brands) to 0.4 mg per gram (VLN). The primary outcome was the number of cigarettes smoked per day during week six.

Results were quite astonishing. The first thing investigators learned was that smoking VLN cigarettes resulted in less total nicotine equivalents per nmol/mg of creatinine in excreted urine (see below).

Ok, this may not be a ground-breaking discovery because it seems obvious that smoking cigarettes with less nicotine result in lower exposure to nicotine, but the graph above clearly demonstrates that smokers were not increasing the number of cigarettes they smoked per day to try to maintain a baseline nicotine level. Additionally, the data show individuals smoking the VLN type cigarettes had no increase in expired carbon monoxide level or total puff volume (i.e. they were not inhaling more smoke), suggesting minimal compensation increase when exposed to VLN cigarettes.

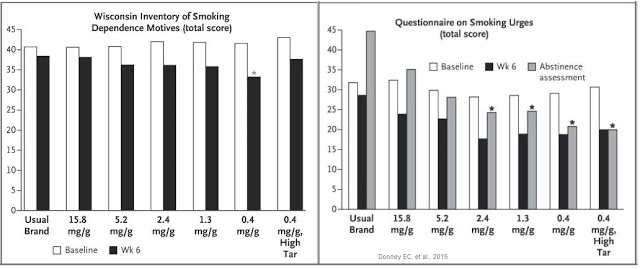

In fact, the opposite happened. Not only did subjects smoking VLN cigarettes have lower nicotine levels compared with control cigarettes, they also reported reduced dependence on nicotine, as well as reducing cravings during abstinence from smoking. This can be seen in the two graphs below.

The combination of reduced nicotine exposure, reduced dependence, and reduce urges to smoke led to fewer cigarettes smoked per day for individuals randomized to VLN cigarettes (14.9) than those assigned to their usual brand (22.2), and that smokers of VLN cigarettes doubled their quit attempts versus smokers of conventional cigarettes over the course of the study.

The study’s lead author, Dr. Eric Donny, explained in an article posted on USAToday.com, “The evidence is getting stronger that reducing nicotine reduces smoking and makes people less addicted to cigarettes and, in doing so, might make them more likely to quit.” Just as important to smokers is the fact that The New England Journal of Medicine articles reflected that smokers had negligible nicotine withdrawal symptoms when using the VLN cigarettes from 22nd Century.

Check out this video put out by NEJM.org talking about the trial >> LINK

Including the study published above in the NEJM, I have found six additional independent clinical studies that demonstrated efficacy and improved smoking cessation with 22nd Century’s proprietary VLN cigarettes.

How Big Is Brand-A?

If the U.S. FDA does approve the MRTP application for 22nd Century Group, I do not see 22nd Century selling the product. It’s simply too big an opportunity. Roughly 265 billion cigarettes were sold in the U.S. in 2014, and the term “modified risk” will resonate with the vast majority of consumers. For example, according to recent data from the U.S. CDC, approximately 70% of American smokers want and have tried to quit smoking. JP Morgan market research shows that 90% would try a “light” product if the term was re-introduced to the market. Sales of e-cigarettes went from zero to $2.8 million in the past decade but have recently begun to “lose steam” according to the Wall Street Journal for a myriad of different reasons, including abysmally low satisfaction rates and serious health concerns.

Smoking cessation market is currently $5.0 billion in the U.S. and expected to nearly triple in the next few years. This number includes OTC nicotine replacement products like gums, patches, and lozenges, as well as FDA-approved pharmaceuticals such as Pfizer’s Chantix® (varenicline) and Glaxo’s Zyban® (bupropion).

If Brand-A were to capture just 1% of the U.S. retail market, which would be similar to the market share that American Spirit has been able to capture with it’s “additive-free” and “organic” image, volume would be approximately 2.7 billion cigarettes or around $750 million in retail sales. If Brand-A were to capture just 10% of the smoking cessation market, revenues would be $500 million.

Altria Group (NYSE: MO) holds approximately 45% of the U.S. retail market for cigarettes. The recently merged Reynolds American (NYSEMKT: RAI) and Lorillard control another 35% of the market. A product like Brand-A is very interesting in the hands of the big boys looking to hold onto market share and stay on top. It’s also potentially very interesting to tertiary players like Imperial Tobacco, British American Tobacco (NYSEMKT: BTI), and Japan Tobacco looking to gain share in the U.S. with a disruptive technology. Recall, 22nd Century Group already has a licensing agreement with British American Tobacco to research and develop altering levels of nicotinic alkaloids in tobacco plants.

Conclusion

I’m encouraged by the quick response and interest from the U.S. FDA on 22nd Century Group’s MRTP application. Of course, the agency could have called management from XXII in to tell them the application was complete junk and has no chance for approval. But then again, did that need to happen in person? Do you need 20 people in the room and another 22 on the phone to do that? Instead, I’m thinking the Brand-A MRTP application intrigues the agency. The evidence supports government interest in this area with SPECTRUM®, and even the former FDA top-dog has voiced support for the concept.

Full disclosure, I haven’t seen the application and it will all come down to the data as noted above; but, I think this is a huge opportunity for 22nd Century Group. The company trades with a market capitalization of only $80 million. Recently, the company put out guidance expecting revenues in 2016 of at least $12 million. That equates to an EV-to-EBITDA ratio of 6.7x, comparable to Altria at 6.2x, Reynolds at 5.7x, and BAT at 5.6x, and includes no contribution from Brand-A. As such, I think 22nd Century Group offers a favorable risk / reward profile for investors.