Last month I wrote a detailed article introducing investors to Oasmia Pharmaceuticals (NASDAQ:OASM), a Swedish-based biopharmaceutical company developing next-generation novel formulations of well-established chemotherapeutic agents through its proprietary nanotechnology platform. Shares of Oasmia are up 50% since that article, and I think the upward momentum in the stock will continue based on some recent positive news.

Quick Refresher on Oasmia

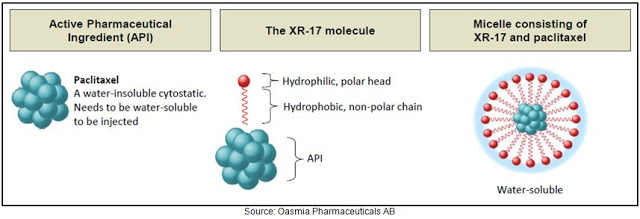

Swedish-based Oasmia develops improved formulations of cytostatic agents (i.e chemotherapies) using a proprietary nanotechnology platform called XR-17. XR-17 utilizes nanoparticles derived from Vitamin A to solubilize hydrophobic active pharmaceutical ingredients (API). The XR-17 molecule contains a hydrophilic (water soluble) polar head and hydrophobic (fat soluble) non-polar chain. The construct of the XR-17 molecule (below) facilitates the formation of micelles (spheres) where the fat-soluble ends fall inside the sphere and the water-soluble components are directed outwards. Accordingly, the fat-soluble ends are “protected” from water and only released when the sphere is dissolved in vivo.

XR-17 is a clinically and commercially validated technology designed to improve solubility, facilitate administration, enhance the pharmacological profile and bioavailability, and allow for dual encapsulation of water-soluble and water-insoluble APIs in one nanoparticle. According to a 2014 report, an estimated 70% of molecules in clinical developmental and 40% of approved drugs are believed to be poorly soluble. Oasmia management believes this creates a tremendous market opportunity for the XR-17 platform technology.

Clinical data to date show no hypersensitivity reactions to XR-17 and the residues are harmless once the micelles are dissolved in the bloodstream, leaving the body through urine. Recent data confirm the pharmacokinetics, safety and tolerability of XR-17. Additionally, this technique is not limited to one API; XR-17 can enclose several molecules in micelles simultaneously regardless of the molecules solubility in water. This allows, for example, for two cytostatic agents to be given in a single infusion, where this regimen would usually require two infusions.

Oasmia’s leading candidate is Paclical®/Apealea®, an XR-17 formulation of paclitaxel. Paclical® was approved in Russia and the Commonwealth of Independent States (CIS) in April 2015 and Oasmia shipped the first batch of product to its Russian distribution partner, Pharmasyntez, in December 2015. The order equated to roughly $9 million in end-user sales. Oasmia has also recently filed for approval of Apealea® in the European Union. Management is currently preparing the U.S. approval application, with a target submission to the U.S. FDA during the second half of 2016. Oasmia reported positive Phase 3 results with Paclical® in June 2014. The data show Paclical® to be non-inferior to Taxol® (generic paclitaxel) in terms of progression-free survival when used in combination with carboplatin for ovarian cancer. The product has been granted Orphan Drug designation in both the U.S. and EU for this indication.

A Validated Market

An improved formulation of paclitaxel is a significant market opportunity validated by blockbuster sales of Abraxane®, a nanoparticle albumin-bound (nab) formulation of paclitaxel that achieved global sales of approximately $1.2 billion in 2015. As a reminder, Celgene acquired Abraxis BioSciences, the original developer of Abraxane®, for $2.9 billion in June 2010. Since the acquisition, Abraxane sales at Celgene have grown by 19% CAGR, and analysts estimate sales for the drug will reach $1.8 billion by 2020 according to Capital-IQ.

Abraxane® is approved for the treatment of metastatic breast cancer (in 2005), locally advanced or metastatic non-small cell lung cancer (in 2012), and metastatic adenocarcinoma of the pancreas (in 2013). With Paclical®/Apealea®, Oasmia is initially focusing on ovarian cancer, an indication for which Abraxane® is not approved. Clinical studies with Paclical® are also ongoing in metastatic breast cancer; however, to be successful, Oasmia does not have to compete directly with Abraxane®. The two products are nearly identical; and although it is clear that certain oncologists will prefer Paclical® over Abraxane® due to the potential for less immunogenicity and a potentially lower sales price, the opportunity for Oasmia and its commercial partners is substantial simply because the entire global paclitaxel market is approximately $2.5 billion in size, and Abraxane® has only 50% market share.

The other 50% share is still generic paclitaxel, which looks like low-hanging fruit for both Celgene and Oasmia. Plus, Oasmia also has a significant potential opportunity in the veterinary market with Paccal-Vet®, the company’s veterinary formulation of paclitaxel. Paccal-Vet® has received conditional approval from the U.S. FDA for the treatment of canine squamous cell carcinoma and mammary carcinoma in February 2014. The veterinary market is a place where Celgene will never be able to play with Abraxane® because the product contains human albumin.

Rinse, Repeat

The Oasmia pipeline is built on the premise of duplicating success in an already validated market. Beyond Paclical®, Oasmia has two additional clinical stage candidates, Doxophos®, an XR-17-doxorubicin formulation and Docecal®, an XR-17-docetaxel formulation. Oasmia also has substantial research in the animal health area with Paccal-Vet® (noted above) and Doxophos-Vet®. These are significant market opportunities that mirror the opportunity with Paclical/Apealea®, albeit with potentially less competition given that there is no “Abraxane-type product” on the market competing with generic doxorubicin or docetaxel.

Oasmia estimates the market for Doxophos® exceeds $600 million on a global basis. The company has already filed for approval of Doxophos® in Russia and expects to gain market authorization by the end of 2016. Oasmia views Russia and the CIS as important introductory markets for its products. The company was active at the 19th Annual Russian Cancer Congress in Moscow presenting data on both Paclical® and the rest of the clinical pipeline.

The market opportunity with Docecal® is significantly larger, perhaps even twice the size of Paclical®. Sanofi’s Taxotere® achieved peak sales of $2.8 billion in 2010, nearly twice the size of Bristol’s Taxol® (paclitaxel). Beyond use in breast and prostate cancer, Taxotere® also sees significant use in cancers not commonly treated with paclitaxel, including head and neck cancer and stomach cancer. On March 30, 2016, Oasmia announced the first patient had been enrolled in the company’s Phase 1 clinical study with Docecal®.

Conclusion

Oasmia has several things going for it that I like. Firstly, this is a proven business model validated by Celgene’s $2.9 billion acquisition of Abraxis in 2010 and Sorrento’s sale of Cynviloq®, a nanoparticle micellar paclitaxel solution to NantPharma for up to $1.3 billion in 2015. Oasmia’s market capitalization is only $150 million, and the company looks to be traveling down the same path as Abraxis.

Secondly, I like that there seems to be very low clinical risk. Based on pharmacokinetic data, Paclical® offers nearly identical mean plasma concentration of paclitaxel after identical doses over three hours. Paclical® is paclitaxel, simply with a better delivery formulation. The Phase 3 data presented at ASCO 2015 shows, at worst, non-inferiority to Taxol®, with the potential to show an improvement in overall survival once the full data is presented later in 2016. The clinical risk, at least with Paclical®, has been mitigated; and the clinical risk with Doxophos® and Docecal® looks equally as low.

Thirdly, I like the fact that Paclical® is already on the market and generating revenues in Russia. Yes, the Russian pharmaceutical market is not nearly the size of the U.S. or European market, but the approval of Paclical® in Russia shows that Oasmia management can execute by getting its drugs approved and striking a commercial partnership to monetize the asset. The EU filing is under review and the U.S. filing is scheduled for later in 2016.

Fourthly, I like the potential expansion of the pipeline, both with new indications for Paclical® and with Doxophos® and Docecal®. Oasmia clearly has a strategy in place to create value for shareholders, and they are building upon existing success with a validated model.

Finally, I like the fact that the company has an animal health division with a U.S. FDA approved product in Paccal-Vet®. According to the American Pet Products Association (APPA), between the U.S. and Europe, there are 143 million dogs and 160 million cats registered by pet owners in these regions. An astonishing 78% of these animals take prescription medication! It’s a $30 billion market between the U.S. and EU. According to the Center for Cancer Research and CanineCancer.com, approximately six million dogs in the U.S. are diagnosed with cancer each year, of which approximately one-third have cutaneous, or skin, cancers. There have been no nanoparticle formulations of injectable chemotherapeutic agents formulated specifically for dogs or cats before Paccal-Vet®. This is Oasmia’s market to capture.

These positive attributes, along with what looks like a low market valuation given the potential for Oasmia to follow a similar path to Abraxis, leads me to believe the positive momentum in the stock should continue.