Last month, I wrote an article introducing investors to HedgePath Pharmaceuticals, Inc. (HPPI), a Tampa-based biopharma company developing an improved, patent-protected, oral capsule formulation of itraconazole for the treatment of Basal Cell Carcinoma Nevus Syndrome (BCCNS) / Gorlin Syndrome. HedgePath is currently enrolling patients in a Phase 2b open-label trial (NCT02354261) of SUBA™-Itraconazole in subjects with BCCNS.

Read my initiation article here >> LINK

Target enrollment in the Phase 2b study is 40 patients. An interim analysis from the first 13 subjects reported last month sent shares soaring, up over 100% at one point. The data showed clinically meaningful reduction in tumor burden for the majority of patients. Specifically, a >30% reduction in total tumor burden was observed in 8 of the 13 of the patients (62%), with the average reduction measuring 60%. These data are nicely above the FDA’s hurdle of a >30% reduction in 30% of the patients for study success.

Read my full analysis of the interim data >> LINK

The interim results were quite impressive, prompting management to state that, “If the final study results are consistent with the interim results, HPPI believes that the current Phase II(b) trial may lead to a possible New Drug Application filing with the FDA.” Of course, this is no guarantee; but, given that SUBA-Itraconazole has been designated as an Orphan Drug and there is the potential for an NDA filing in 2017, the next logical questions is – What’s HedgePath worth?

A Look At Valuation

HedgePath currently trades with a market capitalization of $105 million. Shares trade on the OTC, but with the market value on the rise given the strong interim Phase 2b data, I see a logical path to a Nasdaq listing in the future. I believe if the final analyses from the Phase 2b study are positive, HedgePath will not remain valued at only $105 million for long. Therein lies the opportunity, today.

Recall, because SUBA-Itraconazole targets an orphan disease, management may be able to count the current Phase 2b study as the pivotal registration study. This would not be unprecedented, as both Roche and Novartis were able to gain approval for their respective skin cancer drugs, Erivedge® (vismodegib) and Odomzo® (sonidegib), respectively, based on only Phase 2 data. Both vismodegib and sonidegib target the hedgehog pathway, similar to itraconazole.

However, if we assume that HedgePath’s current trial is a registration-quality study, then positive data would likely send the shares above the Feuerstein-Ratain “Mendoza” line of $300 million. I believe the shares are below $300 million today because investors view the Phase 2b study as “Phase 2” instead of potentially pivotal. Again, there is clear risk that the final results will not match up with the impressive interim data, but using the Feuerstein-Ratain rule as a way to project valuation upon success provides a good starting point to talk about what HedgePath is worth if the NDA goes under review.

A More Traditional Approach

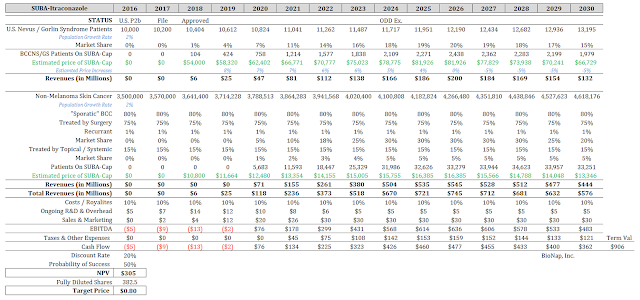

The more traditional approach to valuing a company like HedgePath is to simply model the cash flow and adjust for probability and net present value (NPV). I typically like to start my valuation models looking at the broader target patient population. For SUBA-Itraconazole, the target is around 10,000 individuals in the U.S. with BCCNS. I pulled this figure from a number of sources.

– The U.S. National Institute of Health estimates approximately one million individuals in the U.S. will develop BCC in 2016; however, with roughly 1% of these Nevus / Gorlin syndrome patients (1).

– Work done by Evans DG, et al. in 2010 estimated the incidence rate in the UK at 1 per 30,827 (2) in the UK, which would equate to roughly 10,300 patients in the U.S. assuming similar etiology between the two countries.

– Management has been using the 10,000 figure in its SEC filings and most recent investor presentation (3).

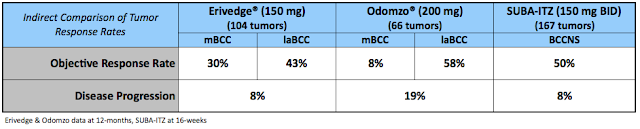

There are no U.S. FDA approved drugs for BCCNS/GS and the market is highly fragmented. Patients are typically treated with excision, Mohs Surgery (chemosurgery), cryosurgery, topical chemotherapy, or photodynamic therapy. Erivedge and Odomzo are not approved for Nevus / Gorlin. Both drugs are approved for locally advanced basal cell carcinoma (laBCC); Erivedge is also approved for metastatic BCC (mBCC). Based on HedgePath’s interim Phase 2b data, I believe that SUBA-Itraconazole compares well with these two drugs on standard measures of objective response rate and disease progression.

As such, if approved for Nevus / Gorlin, I think SUBA-Itraconazole can achieve 25% market share. The drug looks to have an excellent safety profile compared with vismodegib and sonidegib, and I think HedgePath management will price the drug at roughly 50% of where Roche and Novartis have gone (Erivedge cost $10,800 per month (4) & Odomzo costs $10,400 per month (5). This exercise leads me to believe that SUBA-Itraconazole for BCCNS is roughly a $200 million drug.

That being said, the market is likely significantly larger than just BCCNS patients. For example, there are an estimated 3.5 million cases of non-melanoma skin cancer each year in the U.S.; about 2.8 million of these are sporadic BCC (6). As noted above, treatment options vary, but generally speaking 75% of these patients will elect for some form of surgery. Surgical “cure rates” eclipse 95%, and even when the first surgery is not successful, patients usually have a second surgery coupled with PDT or radiation (7, 8). Even if we assume a 99% cure rate, there are still an estimated 21,000 recurrent BCC patients seeking alternative treatment options. I think SUBA-Itraconazole makes sense as an adjunctive therapy for many (I assume 30%) of these patients.

Similarly, one-quarter of the market will see topical or systemic medications, such as Erivedge and Odomzo, or imiquimod or 5-FU. The data shows that SUBA-Itraconazole compares well to these treatment options, so I think it is logical to assume HedgePath can capture 10% of this market. Unlike BCCNS patients, which will likely require constant therapy to prevent lesions, use of SUBA-Itraconazole as an adjunct to surgery or treat sporadic BCC will likely only be for a few months at a time. In Phase 2 clinical studies with Erivedge, patients were typically on drug for 7-8 months (9).

I’ve input all these numbers into a valuation model (see below), along with some objective measures for cost of manufacturing, sub-royalties, ongoing R&D expense, sales and marketing expense, and effective tax rate. I’m using a 20% discount on the cash flow, and then multiplying the entire thing by 50% to factor in risk. For the record, I think SUBA-Itraconazole has a much better than 50% chance to succeed; the biggest risk at this point is timing.

My model pegs the fair value of HedgePath Pharmaceuticals today at $305 million, or $1.00 per share based on the basic market capitalization and $0.80 based on the fully-diluted number. The fully-diluted number would include adding in approximately $7 million in cash.

Conclusion

HedgePath remains an interesting story for small-cap biotech investors. The company is likely to report full enrollment over the next few months, with top-line Phase 2b results expected during the first half of 2017. If the full data look as strong as the interim data presented last month, I expect the company to seek approval for SUBA-Itraconazole via the 505(b)(2) pathway before the end of 2017.

As outlined above, I see the peak opportunity in BCCNS at $200 million, with obvious upside if management can expand the program to adjunctive use in BCC patients or compete with Erivedge and Odomzo in the laBCC and mBCC population. The mechanism of action also holds promise for treating solid tumors where itraconazole has demonstrated utility such as lung cancer or pancreatic cancer. In the meantime, I think the shares are worth $0.80 on a fully-diluted basis, which represents in excess of 100% upside from today.