On November 29, 2016, Cerecor, Inc. (CERC) reported top-line results from a Phase 2 study examining CERC-301 as an adjunctive therapy for the treatment of depression. The study failed to show a statistically significant separation from placebo. In fact, the placebo was superior to the 12 mg dose of CERC-301 using the Bech-6 subset of the Hamilton Depression Scale. The higher dose of 20 mg CERC-301 did show some signs of efficacy, but the results were not meaningful.

CERC-301 is an oral, NR2B specific, NMDA receptor antagonist. I’ve been keenly interested in biopharma research targeting the NMDA receptor for the treatment of resistant depression (TRD). Along with behemoths like J&J and Allergan, small biopharma players such as VistaGen Therapeutics (VTGN) and Relmada Therapeutics (RLMD) are developing NMDA receptor targeting small molecules for TRD. The failure of CERC-301 is relevant to both VistaGen and Relmada.

CERC-301 Failure – Not All That Surprising

CERC-301 is a selective NR2B antagonist of the NMDA receptor subunit. NMDA receptor channels are heteromers composed of the key receptor subunit, NR1, and one or more of the nine subunit variants, NR2A, -2B, -2C, -2D, -3A2, -A2/2B, -AC/2C, -2B/2D, and -2B/3A. NR2B is the glutamate binding side of the NMDA receptor and important in synaptic signaling events and protein-protein interactions. The NR2B subunit is involved in modulating functions such as learning, memory processing, pain perception, and feeding behaviors, as well as many human disorders (1).

Merck initially developed CERC-301 (then called MK-0657) for the treatment of Parkinson’s disease, but the trial failed and Merck discontinued development. At the time of the Parkinson’s trial failure, a Phase 2 study in major depressive disorder (MDD) was enrolling patients. Truncated results from the first five (of 21 planned) patients showed no significant improvement in symptoms of depression for MK-0657 compared to placebo as assessed by the primary outcome measure using the Montgomery–Åsberg Depression Rating Scale (MADRS). However, the results did show a trend toward symptom improvement when assessed by the Hamilton Depression Rating Scale (HDRS) and the Beck Depression Inventory (BDI) (2). The drug was well tolerated, so Cerecor acquired the asset from Merck and reinitiated development as an adjunctive medication in patients with severe MDD who are not responding to current antidepressants (i.e. TRD).

Hindsight is 20/20, but several red flags with CERC-301 were evident. Firstly, the drug failed in previous studies for Parkinson’s and depression. Yes, the Phase 2 depression trial only enrolled five patients before Merck pulled the plug, but if Merck was confident in the outcome it would have kept the trial going. Secondly, Cerecor paid only $1.5 million for the asset (3). I’m not saying incredible deals do not exist and Merck could have earned another $55 million in development and sales milestones, but these are puny numbers for a potential blockbuster depression drug. Finally, several other NR2B antagonist, including traxoprodil, EVT101, eliprodil, besonprodil, and Ro-256981 have all failed and been discontinued at other larger organizations. CERC-301 was a longshot.

Don’t Bet Against NMDA Just Yet!

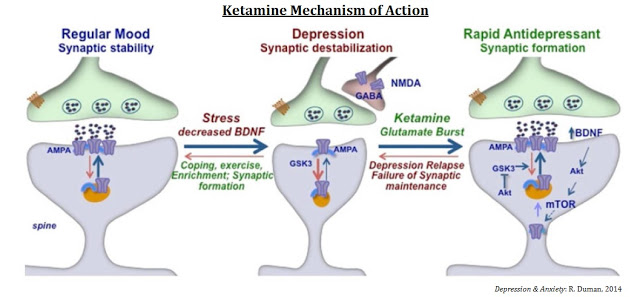

Recent compelling evidence has suggested that the glutamate system is a primary mediator of psychiatric pathology and also a target for rapid-acting antidepressants (4). The NMDA receptor is a glutamate-gated ion channel widely expressed in the central nervous system that plays a key role in excitatory synaptic transmission (5). Abnormalities of glutamate and NMDA receptors contribute to an imbalance in glutamatergic neurotransmission, which may contribute to increased levels of NMDA agonism, thereby enhancing excitatory activity in most brain circuits involved in patients with major depression (6). Rapid responses in subjects with treatment-resistant depression suggest a mechanism that results in fast changes in synaptic function and plasticity (7).

Several companies, including J&J, Allergan, VistaGen, and Relmada Therapeutics are targeting the NMDA receptor with various different strategies. The aforementioned Cerecor focused on the NR2B subunit. J&J and Relmada are focusing on channel blockers, whereas Allergan and VistaGen are focusing on the NR1 glycine binding site. The cartoon below gives investors a good sense of the strategy for each company.

Clear Proof-of-Concept Demonstrated with Ketamine…

Ketamine has moderately high binding affinity for and can block the activity of the NMDA receptor. Scientists at the U.S. National Institute of Mental Health (NIMH) have demonstrated clear proof-of-concept with ketamine as a treatment for major depressive disorder (MDD). In May 2016, a team of researchers out of the NIMH and the University of Maryland published findings in Nature (8) showing that a single administration of a metabolite of ketamine, called (2R, 6R)-hydroxynorketamine, resulted in rapid antidepressant-like effects in mice without ketamine-related side effects, such as anesthesia, or dissociative or addictive behavior (9).

The mechanisms of action for ketamine and other NMDA-receptor antagonists is one of enhancing synaptic function through a shift in activity to the AMPA receptor precipitated by non-competitive inhibition of the NMDA receptor. Administration of ketamine increases extracellular levels of glutamate in the prefrontal cortex. The resulting burst of glutamate caused by ketamine then leads to activation of the signaling machinery (stimulation of BDNF-mTORC1 cascade) that stimulates synapse formation (10). Pre-administration of rapamycin, a selective mTORC1 inhibitor, blocks these effects.

…Which Bodes Well for Relmada Therapeutics

Ketamine, colloquially known as “Special K”, is addictive and has a high potential for abuse or misuse (11). The NIMH study only tested a single dose of ketamine (12), so while the results to date have been very encouraging, researchers are a long way away from a solution. J&J is testing esketamine, the S(+) enantiomer of ketamine, for MDD, TRD, and the prevention of suicide in high-risk individuals. J&J’s clinical efforts to date have been extensive (13). The company is developing both an intravenous and intranasal formulation of the drug.

Phase 2 data with intravenous esketamine were published in Biological Psychiatry in November 2015 (14). The trial enrolled only 30 patients and tested two doses of esketamine, 0.2 mg/kg and 0.4 mg/kg, versus placebo. The primary endpoint was the change in MADRS total score from day 1 (baseline) to day 2. Of the enrolled patients, 97% (29 of 30) completed the study. The least squares mean changes from baseline to day 2 in MADRS total score for the esketamine 0.20 mg/kg and 0.40 mg/kg dose groups were -16.8 (±3.00) and -16.9 (±2.61), respectively, and showed significant improvement (P = .001) for both groups compared with placebo (-3.8 ±2.97).

J&J may be in Phase 3 with esketamine, but that does not necessarily mean they will be the market leader. Treatment-emergent adverse events in the Phase 2 trial were dose-dependent, with the most common being headache, nausea, and dissociation. The authors noted that the dissociation was transient and did not persist beyond four hours from the start of the esketamine infusion, but it concerns nevertheless. The side effects of esketamine may stem from the drug’s affinity for the binding site of the NMDA receptor. Esketamine increases glucose metabolism in the frontal lobe, which has been shown to increase dissociative or hallucinogenic effects (15).

There is little reason to believe the intranasal formulation will reduce these effects and is likely only in development for the convenience of administration. While certainly more desirable than an intravenous infusion, it is still far less desirable than an oral tablet. With the risk of dissociative or hallucinogenic effects, esketamine use may be relegated to a rescue therapy for patients at high risk of suicide.

On the contrary, Relmada Therapeutic’s (RLMD) dextromethadone is an oral tablet and has a significant dosing advantage over esketamine. Dextromethadone preclinical studies have demonstrated strong antidepressant-like effects (16), whereas previous work shows the drug to have a low risk of addiction (17). Relmada recently reported preclinical data with dextromethadone in a well-validated rodent behavioral despair test, also known as the rat forced swim test (18). Results show that a single administration of the drug decreased the immobility of the rats compared to the vehicle, suggesting antidepressant-like activity larger than the effects of ketamine, also tested in the study (see the data here).

Relmada’s Phase 1 data with dextromethadone show the drug to be safe and well-tolerated (19, 20). Data from an independent study conducted by the Memorial Sloan Kettering Cancer Center (MSKCC) published in the Journal of Opioid Management (21) showed patient reported improvements in anxiety and well-being, with no negative cognitive effects or impact on subjects’ mental state. Relmada is currently in the process of planning a Phase 2 clinical study with dextromethadone in patients with treatment-resistant depression (TRD). In short, Relmada’s drug looks to be a better version of ketamine. It’s oral, and results so far show no concerning dissociative or hallucinogenic effects.

Allergan Scoops Up Naurex, Gets Rapastinel & NRX-1074…

Allergan entered the market in July 2015 when it acquired privately-held Naurex for $571.7 million in cash upfront, plus up to an additional $1.15 billion in future potential milestone payments (22). The lead candidate is rapastinel (GLYX-13), a NMDA receptor modulator with GlyB site partial agonist properties. Preclinical and early-stage clinical data points to rapid and long-lasting antidepressant activity, along with potential cognitive improvements in patients with post-traumatic stress disorder (PTSD) (23). In January 2016, the U.S. FDA awarded Breakthrough Therapy Designation to rapastinel as an adjunctive treatment for MDD (24).

Rapastinel’s rapid-acting antidepressant properties appear to be mediated by its ability to activate NMDA receptors leading to enhancement in synaptic plasticity processes associated with learning and memory. Alterations in dendritic spine morphologies associated with the maintenance of long-term changes in synaptic plasticity have been demonstrated in rats following single dose injections of rapastinel (25). These data suggest that rapastinel produces its long-lasting antidepressant effects via triggering NMDA receptor-dependent processes leading to hippocampal long-term potentiation (26).

Not enough yet is know about the long-term safety and tolerability of rapastinel. Naurex reported that in Phase 2 studies with rapastinel, no subjects dropped out due to safety or tolerability issues and that there were no signs of psychotomimetic side effects associated with NMDA receptor antagonists, such as ketamine (27). This is clearly encouraging but will need to be fully vetted in the planned Phase 3 studies. Based on the Phase 2 data, I place rapastinel ahead of esketamine in terms of odds of success and potential peak sales in MDD / TRD.

If there is a knock on rapastinel, it is that the drug is dosed through intravenous infusion. In this regard, Allergan is developing NRX-1074, a backup compound to rapastinel that looks to be more potent and is an oral formulation. NRX-1074 is in Phase 1 clinical studies (28).

…Huge Validation for VistaGen’s AV101

Allergan’s acquisition of Naurex and subsequent breakthrough therapy designation for rapastinel should stimulate investor interest in Nasdaq-listed VistaGen Therapeutics (VTGN) because AV-101 looks to be a better version of rapastinel. AV-101 is an orally available prodrug candidate rapidly converted in vivo into its active metabolite, 7-chlorokynurenic acid (7-Cl-KYNA). 7-Cl-KYNA is a full antagonist of the GluN1 subunit with a similar mechanism to rapastinel (note: rapastinel is a partial agonist).

Clinical and preclinical evidence of the effectiveness of 7-Cl-KYNA has been well-documented in the literature. The drug shows neuroprotective effects in animal models of excitotoxic neurotoxicity (29, 30), anticonvulsant effects in animal models of epilepsy (31, 32), and rapid antidepressant effects without side effects (33, 34). Regarding potency, Naurex’ preclinical data shows that that AV-101 is a more potent GlyB site modulator (35). Phase 1 studies showed good dose proportionality with Tmax of 1-2 hours and a half-life of 2-3 hours. These data compare favorably to the half-life of only 5-8 minutes for rapastinel (36).

In this regard, AV-101 looks more like NRX-1074, only the drug is already in Phase 2 clinical studies. An NIMH-sponsored Phase 2a study (NCT02484456) is currently taking place at the NIH Clinical Center in Bethesda, MD, under the principal investigation of Carlos A. Zarate, MD. Dr. Zarate is one of the nation’s foremost experts in the field of depression and has authored over 100 papers on the subject, including paradigm-shifting work with ketamine recently published in Nature (37). Target enrollment for this study is 24 to 28 adult subjects with treatment-resistant MDD. Data are expected during the second quarter of 2017.

Conclusion

Depression is a debilitating disease that affects approximately 18-20 million Americans. Existing generic antidepressants are only 35-45% effective and that leaves roughly 4 million Americans in desperate need of new treatment options. Scientists recently discovered that abnormalities of the NMDA receptor contribute to imbalances in glutamatergic neurotransmission that may lead to depressive pathology. As an investor in this space, I would not sweat the failure of CERC-301; it was a dubious path from the beginning.

Selective NR2B modulation is only active in about half (4 out of 9) of the NMDA variants (38). Perhaps this is why Cerecor management believes higher doses or more frequent dosing may improve patient response to CERC-301. That may be true, but higher doses may also lead to unwanted side effects. NMDA channel blocking and NR1 (GlyB site) targeting is active in all variants, and thus should have greater potency. These alternative approaches to targeting NMDA offer more hope. Antagonism of the NMDA receptor by ketamine has been shown in both preclinical and clinical models to reverse depressive states rapidly and resolve suicidal ideation after only a single dose. Additionally, Phase 2 data with rapastinel are equally as exciting. These are more validated strategies.

For small-cap companies like VistaGen and Relmada, Allergan conveniently set the price for a post-Phase 2 asset in this market at a whopping $572 million, an 18 and 48-fold increase over the current market value for VistaGen and Relmada, respectively. Cerecor’s exit reduces competition and opens the door for smaller players. I think both VistaGen and Relmada have an excellent chance to succeed. Plus, this is an enormous market. Bristol’s Abilify® costs $30 per day, which means 1% penetration of the 4 million patients in need of new treatment options equates to $300 million in sales!